How the Rise of Healthcare Consumerism Impacts Patient Engagement

As patients experience greater financial risk and responsibility for their healthcare, patients are becoming more active decision makers. They are no longer passive and accepting of healthcare decisions made by providers. Patients are consumers of healthcare and we, as an industry, must change how we think about patient-centricity and focus the lens of our business around what the patient needs.

As we look at the healthcare consumerism trend, what can pharma companies do to better support patients?

We must change internally from a commercial perspective and invest to get patients the information and education they need at critical decision points.

Clinical landscape

Treaters are changing, and the way we treat patients is changing. Today, the number of PCPs has dropped, but the population, particularly the baby boomer generation, is increasing. A reduction in PCPs and increase in patient volume is resulting in less time spent with patients.

As a result, we’re seeing a stakeholder approach to treatment. When we start to look at how we plan HCP strategy – we cannot focus exclusively on physicians as the education of patients is increasingly happening with alternative stakeholders, such as pharmacists, case managers, and health coaches. An impactful HCP strategy should include these providers who are spending more time with your patients.

Financial landscape

High deductible health plans are on the rise, passing increased financial responsibility to patients. Employers are scrambling to adjust benefits to avoid substantial tax fines as patients struggle to adjust to the “new normal.” Patients are not only responsible for higher deductibles, but the type of deductibles are changing as well. Previously applied to medical benefits, now these deductibles are being integrated and include pharmacy benefits. For example, I was picking up an Rx that is normally $25 and was told it was now $170 – my thought: “how much do I really need this Rx?”

Patients are asking themselves the same questions. When you look at your patient savings programs, make sure that you’re working with someone, or building competencies internally, that can manage patient savings programs ensuring two important capabilities: the ability to impose flexible benefit structures and an intelligent application of that benefit. This ensures that you are delivering savings to the patients who need savings – not just a one size fits all approach – which can have a substantial impact on profitability.

As we look to the future, value-based reimbursement will increase in focus. Over the last few years, we have anticipated an increase in value-based reimbursement, but in early application, many physicians didn’t see the linkage between required outcomes and reimbursement.

This February, CMS and a number of private insurers met and came to consensus on the first eight areas of healthcare and 22 areas of quality measures. This helped to start streamlining and clarifying the expectations of both physicians and health systems to support reimbursement. Additionally, it helped providers that are participating in value-based reimbursement to understand the implications of performing and not performing. We anticipate this trend to continue, and accelerate.

In the movement toward value-based reimbursement, we should anticipate the rise of value-based contracting. Gone will be the days of deep discounting to secure preferred formulary status (with the possible exception of generics). When you look at innovative medications, we’re going to have to come to the table taking on some of the risk and responsibility – preferentially in a shared risk model. We will have to prove outcomes of our treatments, inclusive of the associated services and solutions we provide, to improve the overall financial profile to the plan.

Operational landscape

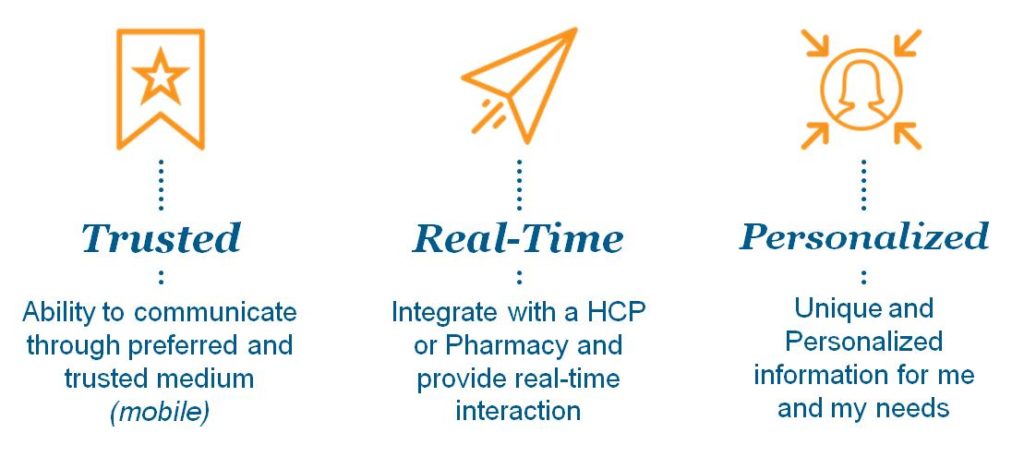

Patients are seeking information through non-traditional channels, which are critical for optimized engagement. Ninety-five percent of people have a mobile phone. By 2017, 65% of patients will be actively seeking health solutions via mobile device. Engaging patients via mobile is becoming a fundamental requirement. So how do patients want us to communicate?

When personalized resources and education are delivered in real-time, from a trusted healthcare source, adherence rates for medications have increased 3x over baseline.

Less fundamental, but growing in popularity, is engagement via social media. Forty-two percent of patients are engaged in social media and of that group, 40% act on something from social media. Historically, manufacturers have been more reluctant to participate in social media due to risk containment. With these engagement numbers growing, manufacturers will need to re-evaluate how to get involved, in a responsible and effective manner, to provide patients with the information and resources they need when and where they’re having the conversation about the company or the products.

Behavioral landscape

Beyond C.F.O., there is a critical 4th dimension that can be overlooked – behavioral.

As they walk out of a physician’s office, 50% of patients do not remember what they discussed. Patients walk out with a prescription and often do not recall instructions around dosing or lifestyle changes. Assuming they take the prescription to the pharmacy, only about 50% are adherent and only 10% make the requested lifestyle changes.

Most non-adherence is not caused by drug costs. Express Scripts recently reported that 69% of the problem is behavioral – simple procrastination and forgetfulness, barriers which can be overcome with the right support resources. Improving these statistics can have a significant impact on outcomes – which are increasingly important to value-based care.

In summary, patients are becoming more engaged and empowered, leading to the importance of the trend of patient consumerism. How should Pharma respond? By addressing the 3E’s of healthcare consumerism:

- Empathy: mobilize our organizations to be able to serve patients differently – to be able to serve healthcare differently. Everyone must understand the patient and the value of the patient. It is important that all members of the organization – inclusive of support functions (legal, regulatory, finance, etc.) – understand what patients are going through as they make decisions.

- Engagement: expand how we think about patient engagement. We can no longer work on education and resources to HCPs exclusively. Our HCP strategy must include complementary providers who are spending more time with patients. Today’s patients want individualized information in the channels in which they normally engage. Brands must integrate tools and services within these channels to deliver the right information for the right need at the right time.

- Empowerment: prioritize patient resources. Patients are becoming active participants in decision making with their physicians and at the pharmacy. This is being driven by the increased proportion of cost that has shifted to the patient. Pharma can no longer deprioritize patient resources as budget reductions are made. These resources must take a minimum of a shared priority within strategic plans and spends.

Ultimately, as an industry we must invest in the education, tools, and resources to help patients become more informed and active participants of healthcare. As healthcare consumerism continues to rise, this investment must happen. If not, we will miss an opportunity that we have to impact overall brand and, most importantly, patient health.

One comment

James DiGiorgio

September 30, 2016 at 4:08 pm

Excellent analysis and assessment of where healthcare is going related to consumerism and patient engagement.